Indianapolis is the state capital and most populous city in Indiana, having approximately 890,000 people. It is also the county seat of Marion County, home to many historic landmarks and quaint residential neighborhoods.

Due to its flourishing economy, attractive communities, abundant recreational opportunities, and easy access to government services, many people aspire to make this city their permanent home.

Indianapolis is also a great place for professionals looking to develop their careers because of the wide variety of job opportunities available in different fields.

Art galleries, theaters, and music festivals contribute to the city’s thriving cultural environment, giving locals even more fun recreation opportunities.

Not only that, but people with different financial means can find lovely homes for sale across the city, from affordable flats to lavish mansions. The city’s many idyllic neighborhoods, accommodating various preferences and lifestyles, foster a great sense of community and inclusivity.

If you are one of those who are planning to relocate to Indianapolis and actively looking for a property to purchase and turn into a lovely home, this article is for you! As you begin your home-buying journey, you should always remember to factor in closing costs.

Along with the property’s price, there are additional expenses involved in finalizing the purchase, and these are known as closing costs.

Let’s talk more about these incremental expenses that you should know before finalizing a real estate deal. This tailored guide to Indianapolis closing costs will come in handy.

Defining Closing Costs

Photo by Paul Brennan on Pixabay

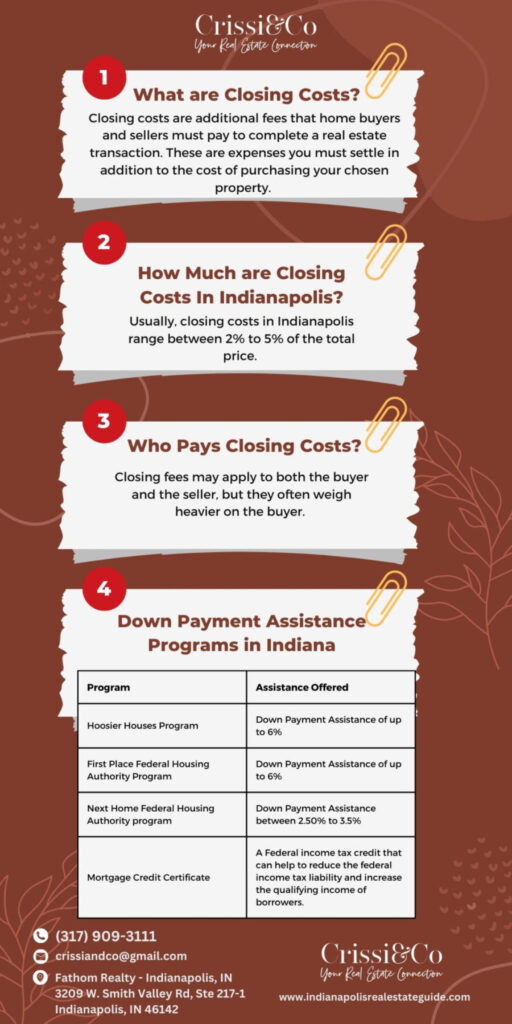

Closing costs are additional fees that home buyers and sellers must pay to complete a real estate transaction. These are expenses you must settle in addition to the cost of purchasing your chosen property.

These costs may include various fees related to different services, such as inspections, appraisals, and title searches. Aside from that, closing costs also cover professional and related expenses, including attorney fees, loan origination fees, and taxes. Mortgage companies are obligated to include these extra expenses when calculating loan amounts.

Closing fees may apply to both the buyer and the seller, but they often weigh heavier on the buyer. Usually, closing costs in Indianapolis range between 2% to 5% of the total price.

However, it may vary depending on many factors, including the property’s location, the type of financing you will obtain, and the parameters agreed between the buyer and seller.

Before signing a purchase agreement, home buyers should be aware of and understand all closing costs involved in the deal.

As a buyer, you need to thoroughly understand all of the associated costs in your real estate deal, including closing costs. You need to prepare financially and avoid complications throughout the home-buying process.

Although there are fixed closing fees, you can negotiate with the seller or lender to reduce some of the remaining charges. Buyers should coordinate closely with their real estate agent or attorney to get the most favorable closing costs.

Buyers and sellers should set aside funds to cover closing costs to ensure that the transaction goes off without a hitch and is ultimately fulfilling for both parties.

Buyer Closing Costs in Indianapolis, IN

Photo by Emre Can Acer

Home buyers must pay a certain amount of closing fees to the seller to legally acquire possession of the property. These costs are often negotiable, depending on the agreed terms of both parties.

For buyers, some of the five most common closing costs in Indianapolis, IN, are identified as follows.

| Buyer’s Closing Costs | Description |

|---|---|

Loan Origination Fee (1% of the mortgage loan amount) | Fee charged by your lender to cover the process of originating a loan. |

Mortgage Escrow Account/ Impound Account (Varies) | Your mortgage lender will open an escrow account, also called an impound account, to hold funds until they are needed to cover costs associated with your home. |

Appraisal Fee (Usually between $300 and $500) | This fee is paid to an appraiser for their professional opinion on a property's value. Simply put, it is the payment to determine the property's worth. |

Title Insurance (Typically around $200 to $250) | Title insurance is indemnity insurance that protects lenders and purchasers against financial loss resulting from property title issues. |

Land Survey Fee (Prices might begin at $250 and go greater from there, depending on how big the plot of land is) | A land survey fee is the amount of money you pay for a detailed mapping of the legal boundaries of a particular property. |

Down Payment Assistance Programs in Indiana

Photo by Roger Starnes Sr on Unsplash

| Program | Description, Eligibility, Limit |

|---|---|

| Hoosier Houses Program | Description: Low-income families, seniors or retirees, and people with disabilities can get help finding affordable housing in approved areas of Indiana through the Hoosier Houses Program. Eligibility:

Limit:

|

| First Place Federal Housing Authority Program | Description: Eligible borrowers may receive up to 6% of the initial mortgage amount as a down payment and/or closing cost assistance under the initial Place Loan program. Eligibility:

Limit:

|

| Next Home Federal Housing Authority program | Description: Down payment assistance is available through this 30-year fixed-rate program for purchasers of single-family homes. From 2.50% to 3.5% of the home's purchase price or its assessed value is available for down payment assistance. Eligibility:

Limit:

|

| Mortgage Credit Certificate | Description: Mortgage credit certificates, or MCCs, are documents given to borrowers by their first mortgage lenders that allow them to claim a tax credit equal to a percentage of their mortgage interest payments. It is a Federal income tax credit that can help to reduce the federal income tax liability and increase the qualifying income of borrowers. Eligibility: |

Calculating Closing Costs in Indianapolis, IN

Photo by Naomi Ellsworth on Unsplash

It’s not uncommon for closing fees to break the bank, particularly for low-income households. The cumulative effect of these costs may be financially difficult for those already trying to make ends meet.

Fortunately, the typical closing expenses in Indianapolis are lower than in many other large cities in the country, and there are also numerous housing assistance programs. It greatly eases the financial burden on families and individuals trying to purchase their starter homes in Indianapolis.

To know how much money you’ll need to cover your closing costs, check out a few illustrations below.

A home buyer can expect to spend at least $2,949.25 to $11,797 in Indiana, where the median listing price is $251,000 as of June 2023.

Here are other computations of the expected buyer closing costs at 2.35%, 3.5%, and 5% closing cost percentage, for future reference:

At 2.35% Closing Costs

| Property Cost | Buyer Closing Costs | Total Upfront Cost(With 20% Down Payment) |

|---|---|---|

| $125,500.00 | $2,949.25 | $28,049.25 |

| $188,250.00 | $4,423.88 | $42,073.88 |

| $251,000.00 | $5,898.50 | $56,098.50 |

| $376,500.00 | $8,847.75 | $84,147.75 |

| $502,000.00 | $11,797.00 | $112,197.00 |

At 3.5% Closing Costs

| Property Cost | Buyer Closing Costs | Total Upfront Cost(With 20% Down Payment) |

|---|---|---|

| $125,500.00 | $4,392.50 | $29,492.50 |

| $188,250.00 | $6,588.75 | $44,238.75 |

| $251,000.00 | $8,785.00 | $58,985.00 |

| $376,500.00 | $13,177.50 | $88,477.50 |

| $502,000.00 | $17,570.00 | $117,970.00 |

At 5% Closing Costs

| Property Cost | Buyer Closing Costs | Total Upfront Cost(With 20% Down Payment) |

|---|---|---|

| $125,500.00 | $6,275.00 | $31,375.00 |

| $188,250.00 | $9,412.50 | $47,062.50 |

| $251,000.00 | $12,550.00 | $62,750.00 |

| $376,500.00 | $18,825.00 | $94,125.00 |

| $502,000.00 | $25,100.00 | $125,500.00 |

With its affordable closing costs and exquisite real estate market, it is no wonder why Indianapolis has been attracting more and more homebuyers through the years.

If everything remains consistent and stable, the local economy of Indianapolis will surely thrive, potentially leading to a rise in the city’s homeownership rate, which could provide more excellent investment opportunities.

Wrap Up

Closing costs are inevitable expenses that buyers and sellers must consider when planning to enter a real estate transaction. It covers fees paid for appraisals, inspections, and assessments.

Buyers should prioritize thoroughly examining the estimated closing costs before finalizing a home deal to avoid complications and financial hardships in the long run.

After all, closing costs can significantly impact the overall affordability of a property. Understanding and considering closing costs is essential for a smooth and successful real estate transaction.

If you are looking for a seasoned realtor to assist you in your home-buying journey in Indianapolis, you’ve come to the right place! I am well-versed in the local real estate market of Indianapolis, and I can give you essential tips and insight to help you make informed decisions.

With my extensive experience in the industry, I have built a strong network of connections that can benefit you in finding your perfect home. Contact me today to get started on finding your dream home in Indianapolis!

You can connect with me by calling (317) 909-3111 or emailing at crissiandco@gmail.com. I also have my social media platforms where you can check for the latest news and trends about the city!

Frequently Asked Questions

How much are the closing costs on a house in Indianapolis, Indiana?

Closing costs usually amount to between 2% and 5% of the home’s purchase price.

What are the closing costs for real estate in Indianapolis, Indiana?

Loan origination, appraisal, title insurance, and land survey fees are some of the most typical buyer closing fees in Indianapolis, IN.

Who usually pays for title insurance in Indiana?

The buyer is the one who usually pays for the title insurance in Indiana.